What Is the Wells Fargo Routing Number?

The Wells Fargo routing number is one number sequence that plays a critical role in financial transactions, especially to clients of this established bank. Have you heard about it before, or are you just doing so for the first time? You should pay attention because it has a lot to do with your account.

This number is rather distinct—9-digits—and can be useful in determining the company’s identity as the financial institution that handles various types of transactions, including those as direct deposits, wire transfers, and bill payments.

In any case, whether it is a money transfer to a friend, setting up a payroll payment system, or the payment of various bills, it is necessary to have the right routing number to help with facilitating and effective execution of financial transactions.

As a large bank in the U.S. market, Wells Fargo has assigned specific routing numbers to cater for the various regions as well as for different types of transactions.

When you know how your routing number works and how to properly use it, you will have more time, less trouble, and a better banking experience.

Where Do I locate a Routing number for Wells Fargo?

It is easy to get your Wells Fargo routing number and important to do that for various financial processes. Here’s how to locate it:

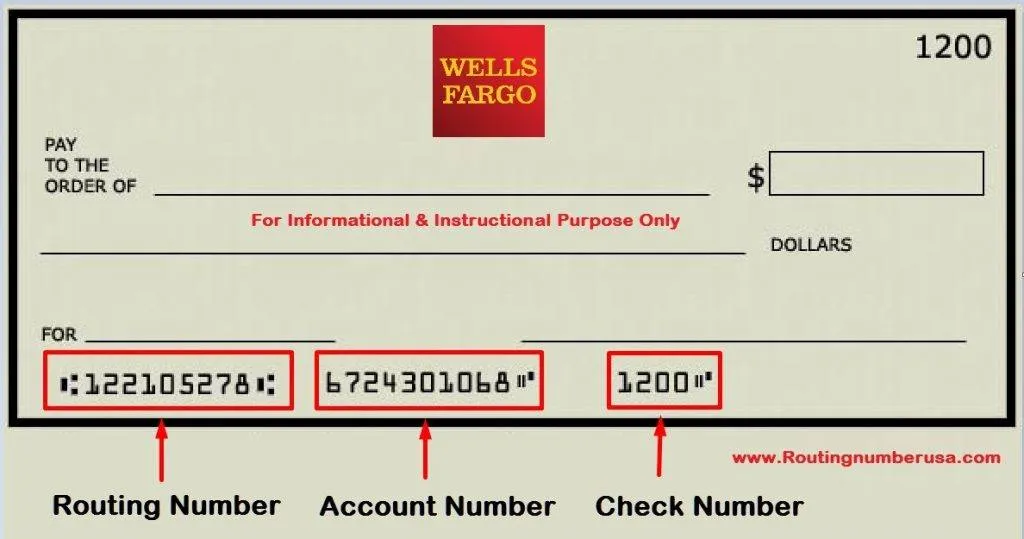

1. Check Your Checks: Wells Fargo checks display the routing number at the bottom left of the check and is the first nine digits.

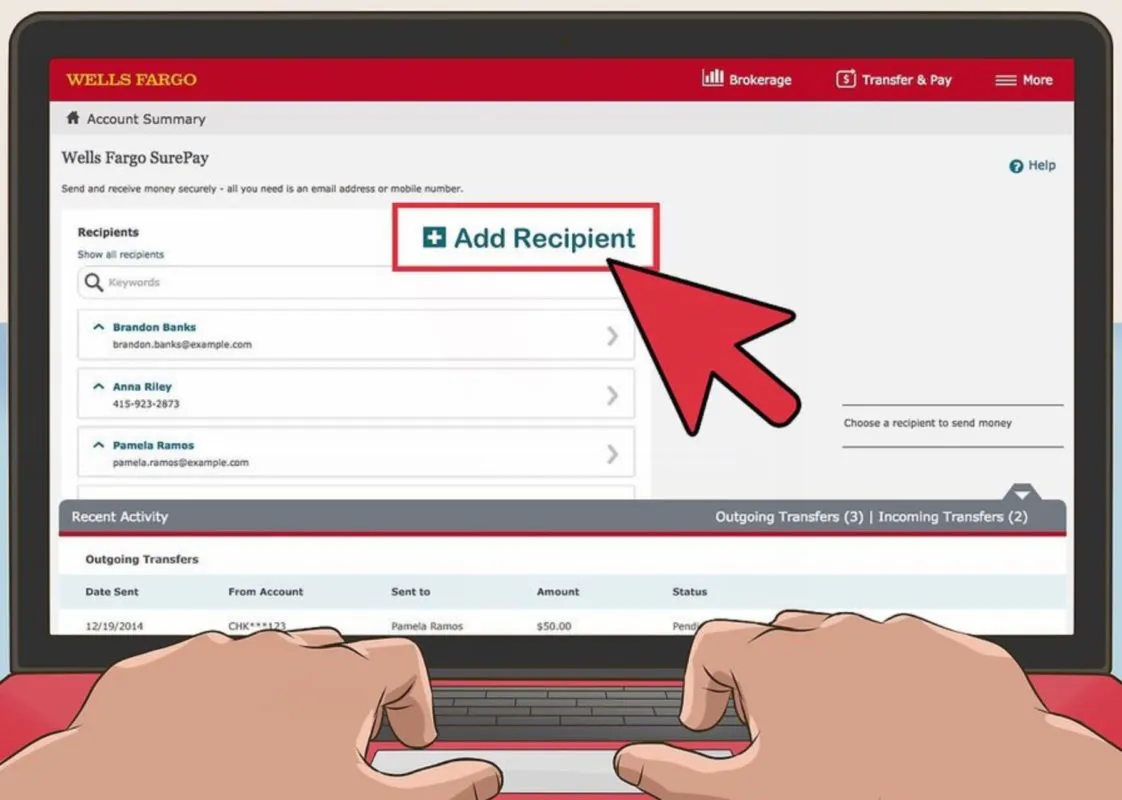

2. Online Banking: If you are an online banking customer, simply go to the account details tab of the Wells Fargo site and search for the routing number.

3. Mobile App: View the routing number by logging into the Wells Fargo official mobile app, then select account details.

4. Bank Statements: The routing number can be found at the bottom of your printed bank statement or an e-bank statement.

5. Contact Customer Service: Check your Wells Fargo routing number by calling the customer service number; the phone number is 1-800-869-3557.

They also help you have the right routing number for your account and type of transaction each time it is needed.

READ ALSO:

- Understanding Wells Fargo CD Rates to Maximize Savings Opportunities

-

Carter’s Credit Card: How to Pay Carter’s Credit Card Online

What is the Wells Fargo Routing Number Used for?

The Wells Fargo routing number is a 9-digit number assigned to the bank for proper identification to enhance the transaction process.

All the check transactions in Wells Fargo have a unique account routing number depending on geography or type of transaction.

This number is indispensable for numerous financial activities, such as:

1. Direct Deposits: Routing numbers are also used in organizations to transfer salary and wages directly into the employees’ accounts.

2. Wire Transfers: The routing number makes sure that other wire transfers, both domestic and international, get to the right recipient.

3. Automated Payments: Groceries, bills, and a lot of other purchases need a routing number as a rule of multiple reoccurring payments.

4. ACH Transfers: ACH represents the secure money transfer in-between banks through routing numbers.

5. Tax Refunds: It is used when filing taxes, therefore guaranteeing refund delivery right into the bank account.

The Wells Fargo routing number ensures that transactions are done correctly and within the right time, hence saving the inconveniences of erroneous or delayed business.

Can I Change the Wells Fargo Routing Number?

Indeed, your Wells Fargo routing number can be altered, though that would be only possible in some particular conditions. Here’s when and how it may happen:

1. Relocation: It is usually crucial to acquire a new routing number because Wells Fargo allocates numerical codes for routing geographically.

2. Account Type Change: Alternating between account types, like from personal checking to business accounts, there may be a need to use a different routing number.

3. Bank Merger: Perhaps Wells Fargo joined with another bank or decided to alter some operations; that’s why your routing number was changed.

Steps to Update Your Routing Number:

1. Identify the New Number: Contact Wells Fargo to make sure that they now have the updated routing number.

2. Update Payment Information: Modify your routing number with your payroll, subscriptions, as well as your payment for bills.

3. Check Your Checks: One thing you can do once you’ve changed the routing number is to order new checks with the new number imprinted.

4. Monitor Transactions: Avoid jumpiness and switch off by keeping an eye on your account to spot inconsistencies.

READ ALSO:

-

Big Lots Credit Card Login: Easiest Way to Manage Your Account

- 6 Best Instant Cash Advance Apps for Emergencies

Is It Legal to Share the Wells Fargo Routing Number?

Yes, you too can disclose your Wells Fargo routing number, but only when it is required and with the right authorities.

Alerting others to this number is generally okay for very limited usage, such as deposits or payments.

Reasons to Share the Routing Number:

1. Direct Deposits: Routing number required for the deposit of salaries.

2. Setting Up Payments: Power and water companies, as well as magazine and newspaper subscription services, need routing numbers for billing.

3. Receiving Funds: For your family and friends to deposit money into your account, they require the routing number.

4. Tax Refunds: The routing number for direct deposit refund is needed to file taxes.

5. Loan Payments: Routing numbers are utilized by lenders to withdraw installment payments.

But make sure the recipient is real in order not to fall victim to con men and women.

Final Words

Your Wells Fargo routing number should be comprehended and effectively controlled in order for everything to flow nicely.

Whenever one is establishing direct deposits, making a transfer, or making a payment, then the routing number plays a critical role in getting it right.

In that case, the purpose of this is to ensure the reader learns how to locate, utilize, and modify that routing number to minimize the occurrence of setbacks and mistakes when seeking the full advantages that your banking can provide.

Always respect your routing number and only provide it to entities or organizations that you trust and that need to transact with your account.

With this knowledge, you are safely anchored to steer your financial activities and experience the proper functioning of Wells Fargo services.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.