Understanding Wells Fargo CD Rates to Maximize Savings Opportunities

CDs as financial products offered by the Wells Fargo bank entail the yield of the customers’ money over a stipulated period without risk to the customer’s capital. We can bet you are already lost at this point but ready on, as we promise to give you understanding soon.

At relatively low interest, we find such products, and these go to the class of investors who seek steady income on their investment.

Overall, the CD rates of Wells Fargo can best be described as a combination of both flexibility and growth and, as such, count as a crucial weapon in the arsenal of any person planning for the future.

Some clarification on the terms is in order, so customers can achieve the most out of safe savings with one of the leading financial institutions in the United States.

What are Wells Fargo Certificate of Deposit Rates?

CD rates are the interest rate that Wells Fargo offers the client for depositing money in a term deposit account.

These rates are negotiated in advance and fixed, and that too does not fluctuate according to market forces.

Wells Fargo has its basic and promotions CD rate depending on the term, the amount deposited, and if the customer has a qualifying Wells Fargo account.

CDs are apt for people that require higher interest rates than normal savings accounts but with standardized security and certainty.

What is the Current Wells Fargo Interest Rate?

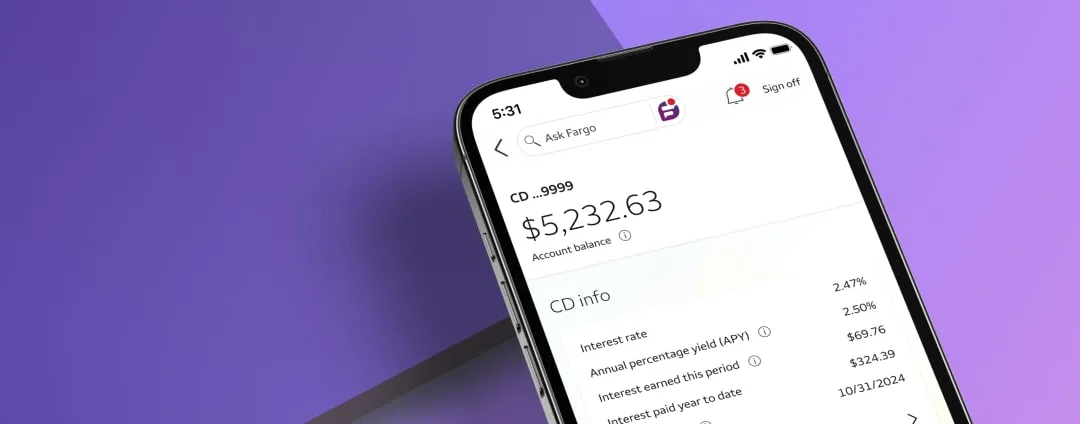

As of today, Wells Fargo offers the following special CD rates:

1. 4-Month Fixed Rate CD: Get paid an Annual Percentage Yield (APY) of 4.00%. Some of the relationship customers might even get better APY rates than all these ones highlighted in this passage.

2. 7-Month Fixed Rate CD: Provides 3.75% APY and can be used to combine funds for medium-term investments.

3. 11-Month Fixed Rate CD: Offers a stable 3.50% APY, with both high liquidity and good revenues.

For clarity, if a customer puts $10,000 in a 4-month CD at 4.00% APY, the customer will get approximately $133 upon the CD’s maturity, without a cash-out.

These rates make Wells Fargo a great bank specifically for the individuals that are saving for the short term as well as those who save for the long term, as the interest rates are quite reliable.

What is the Highest Interest Rate in Wells Fargo?

Wells Fargo’s Platinum Savings Relationship Interest Rates provide the highest returns for premium depositors:

- $0 – $99.999.99: Earn 0.26% APY.

- $100,000 – $499,999.99: Earn 1.02% APY.

- $500,000-$999,999.99: Earn 2.01% APY.

- $1,000,000 or more: Make the apparently high 2.51% APY money.

These higher rates vary with the amount of money that customers deposit and the period that they propose to use the banking services.

Wells Fargo provides such a rate for individuals who want to transfer their money and get better banking services.

READ ALSO:

- Wells Fargo Credit Cards: Convenience in Digital Banking

-

Temu Scams: Debunking the Myths and Protecting Yourself Online

6 Ways to Earn Higher Wells Fargo CD Rates

It is obvious that many who understand and have interest in making the most will want to learn how to earn better. Here are some tips for you:

1. Choose Longer Terms: Some tips to improve APY include: Besides, longer CDs’ terms provide better rates from banks who see APY earned from long-term commitments.

2. Use Special Rates: Thus, look for promotion rates such as the 4-month and the 11-month promotions, which produce higher rates compared to normal certificates of deposits.

3. Leverage Relationship APY: Extended lowering of qualifying accounts for relationship customers.

4. Avoid Early Withdrawals: Premature withdrawals attract penalties, resulting in low profits, which are common with this type of account. Therefore, it is important to adhere to the term length set.

5. Diversify CD Investments: Use CDs with different maturity dates (CD laddering) so that you will always have money to invest at a higher rate in the future.

6. Reinvest Earnings: To increase returns resulting from grown CD’s, roll-over matured CDs into fresh ones to capitalize on compounded growth rates.

Considering the Nature of Benefits Fiscal APY Advantages

Several are as follows: Wells Fargo gives the enhanced interest rate referred to as the Relationship APY-if a customer has linked checking or a savings account with the bank.

This incentive persuades customers to undertake all their banking business with Wells Fargo, which results in the desire of the customer to earn more while the bank earns the loyalty of the customer.

How to Open a Wells Fargo CD

Opening a CD at Wells Fargo is a simple process:

1. Choose a Term: We, thus, have to determine the period that will be favorable in ensuring achievement of the set monetary targets.

2. Select a Type: Choose between regular or promo prices.

3. Deposit Funds: Minimum deposit required differs, but for special CDs the minimum amount required is not less than $2,500.

4. Set Up Online Access: You can in fact manage your CD through the convenience of Wells Fargo online banking.

Using the Internet, at a branch, or by contacting Wells Fargo’s customer service, CDs can be opened.

READ ALSO:

Why CDs are Right for Conservative Investors

Any person willing to invest their money but at the same time is afraid of losing their hard-earned cash through risky products like shares, then CDs are the best option available.

FDIC-insured, have fixed returns, and have standard growth rates of return. Wells Fargo CDs are ideal for retirees, high savers who are planning to make a big purchase, or any other saver who wants a risk-free investment.

Wells Fargo CDs vs Competitors

However, the interest rates offered by Wells Fargo in its certificate of deposit are reasonably good, but not always the best around.

The residents should ensure they compare their rates with those of the other different banking institutions.

Wells Fargo, though, offers good rates that are almost as favorable as those of Fidelity, has relationship perks, and boasts of good customer interaction.

Note

A savings product such as a Certificate of Deposit (CD), which is a relatively risk-free savings scheme wherein, once opened, no further deposits can be made.

Wells Fargo CDs carry FDIC insurance for every depositor up to $250,000. When the term is due, you may take the money in cash, purchase a new CD, or transfer the money to another account.

It is allowed to withdraw before age 59½, but the penalty imposed leads to a decrease in the amount of interest earned.

Final Words

Wells Fargo CD rates are a predictable, safe way to accumulate your money while enjoying the advantages of working with one of the USA’s most reputable banks with upscale services.

Options for targets of investment in addition to relationship APY for loyal customers make Wells Fargo CDs an effective financial instrument no matter the financial goal.

Regardless of your reason ranging from future use in aspects such as retirement, purchase of a big item, or the mere desire of watching your money appreciate, Wells Fargo CD rates should interest you.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.