Does Wells Fargo Have Zelle for Transactions?

Wells Fargo joined other banks in providing online payment services to serve its customers. To find the answer to your question about Zelle payments Wells Fargo offers, you will learn that Wells Fargo includes Zelle in its services.

Wells Fargo gives their customers convenient access to Zelle through their mobile banking and online platforms for instant money transfers.

Through Zelle, customers at Wells Fargo can easily transfer payments securely to friends, roommates, and family members.

This shows how Wells Fargo employs Zelle and reveals its advantages, including protective safeguards as well as other important facts.

How Did Wells Fargo Integrates Zelle into Customer Services?

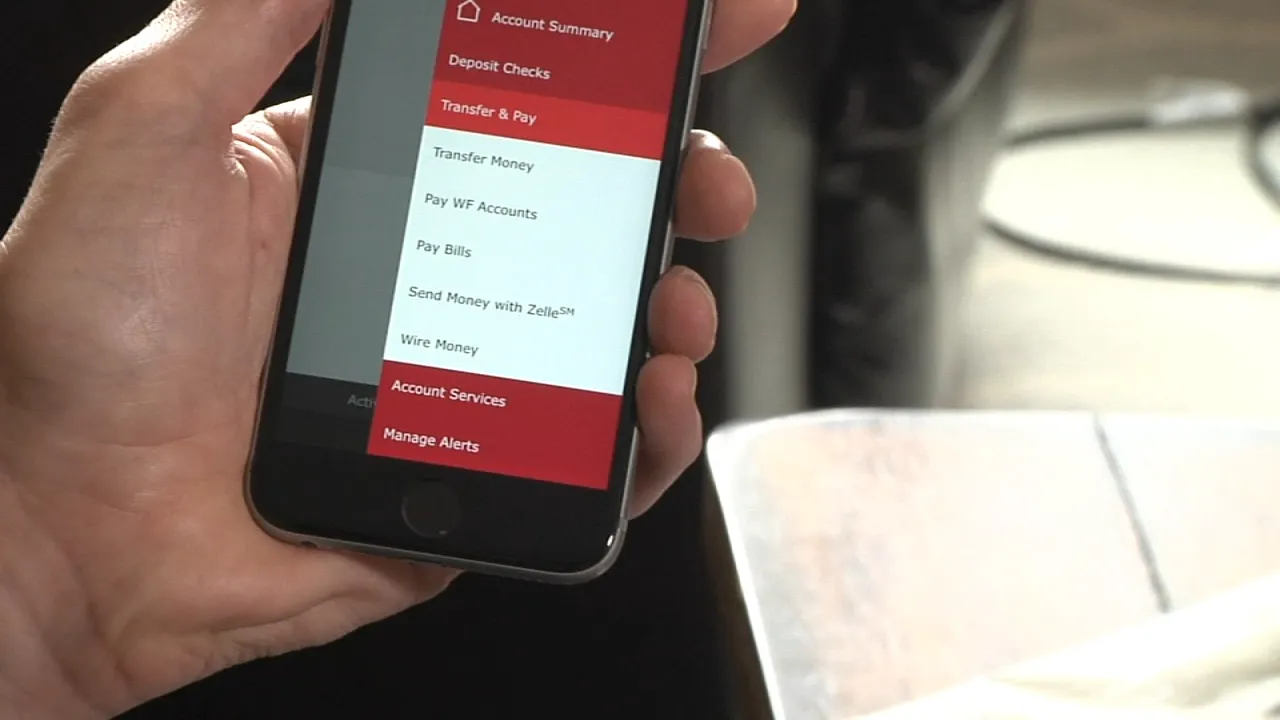

Wells Fargo lets its customers access Zelle through their own personal banking app and internet platform.Customers can use Zelle through Wells Fargo’s existing application program. To use it, customers must:

- Open the Wells Fargo mobile app or online platform using your account credentials.

- Find the Zelle service through the payment transfer options under your Wells Fargo account.

- Customers need to provide a US email address or mobile number to join the Zelle service.

- Select the account you want to send money from (the checking account).

- Send money to recipients by entering their U.S. mobile number or email address right away.

People who use Zelle can transfer and receive money fast from enrolled account users since each transaction happens instantly.

Does Wells Fargo Provide Zelle Service to Its Customers Free of Charge?

Clients of Wells Fargo do not need to pay for Zelle usage. Wells Fargo customers can perform money transfers online for free among other bank account holders without paying any additional fees.

Users must understand they could receive regular mobile texting and data service fees from their wireless provider.

Customers need to verify if their recipient bank includes fees for Zelle transactions since Wells Fargo does not charge for this service.

What Are the Benefits of Using Zelle with Wells Fargo?

You gain many benefits from using Zelle through Wells Fargo services.

- Every transfer through Zelle finishes rapidly within a few minutes.

- Our customers use a single Wells Fargo application since they can access Zelle features right from the app.

- The bank uses advanced security systems to shield Wells Fargo account transactions.

- Free for Wells Fargo customers.

- The system works with all leading U.S. banks to give people easy access to the service.

Zelle provides Wells Fargo customers an ideal way to make secure, fast payments.

READ ALSO:

What Are the Money Transfer Restrictions on Zelle Through Wells Fargo?

Through Zelle transfer limits, Wells Fargo defends both customers against thieves and inappropriate fund usage.

- Daily Transfer Limit: Up to $2,500 per day.

- Monthly Transfer Limit: Up to $20,000 per month.

Wells Fargo places additional monetary restrictions on customers based on specific bank relationships.

Users receive transfer restrictions that Wells Fargo sets separately for different account types and transaction histories. Consult the Wells Fargo mobile app to view your personal transfer restrictions.

How Secure Is Zelle with Wells Fargo?

Bank transfers need top-level security protection. Wells Fargo uses multiple security tools to safeguard Zelle user accounts.

- Your account has two security layers (MFA) to stop unauthorized users from getting in.

- Wells Fargo uses strong encryption to protect customer financial and personal details.

- Our system sends messages to customers about all recent account events.

- Wells Fargo uses fraud tracking to see if any transactions appear strange.

Customers must send their money only to trusted parties because Zelle transfers become permanent once payment processing starts.

Can Wells Fargo Customers Use Zelle for Business Transactions?

You can use Zelle for selecting business accounts with Wells Fargo. However, business users should note:

- The Zelle platform matches perfectly with small companies for payments to suppliers and buyers.

- Every Wells Fargo business account gets its own standard transfer restrictions, which differ from personal account limits.

- Zelle does not process payments outside the United States.

Wells Fargo will explain the Zelle services available to each business owner and show their transaction amount limits.

READ ALSO:

- Is Temu a Scam? Debunking Temu Scam Rumor and Why its Seen as a Scam

-

Wells Fargo Credit Card Login: A Smart Way to Manage Your Account

-

5 Best Crypto Gaming Projects: Blockchain and Entertainment for the Future

Can You Perform Zelle Transactions from Wells Fargo Credit Cards?

Wells Fargo does not provide the option to use Zelle with credit cards. Users should select an active checking or savings account to transfer funds with this service.

You can use Zelle services if you have an approved Wells Fargo bank account for deposit transactions.

Also, when a Zelle payment fails, it happens because of one of the following problems:

- The recipient did not set up Zelle for money transfers.

- You gave us invalid contact information.

- Insufficient funds in the sender’s account.

- Limitations on the number of daily or monthly transactions have been exceeded.

- Bank processing issues.

Contact Wells Fargo customer service when a Zelle transaction fails to determine the issue through the proper details and recipient enrollment verification.

Bottom Line

Wells Fargo lets customers use Zelle without difficulties, so they can easily transfer money to and from this service.

Customers of Wells Fargo value Zelle for its straightforward service that enables secure moment transfers at no cost.

You can easily transfer money to your contacts and make payments through Zelle within the Wells Fargo platform.

Using Zelle with Wells Fargo requires you to learn adjusting to its specific operational boundaries and security steps to have an effortless experience.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.