10 Cash Advance Apps Like Moneylion

Getting cash advance apps like Moneylion is one step in the right direction if you are looking for an alternative to this popular cash advance app. However, getting the best of them should be your priority.

According to a survey conducted for US citizens, more than seventy percent of them accepted the fact that they often run out of cash before their payday.

This situation often causes them to experience a cash flow obstacle. To manage this kind of situation, you will need cash apps like MoneyLion.

Here, we will furnish you with a list of 15 cash advance apps that can serve you just like MoneyLion.

Cash Advance Apps Like Moneylion

To keep some cash with you even when your payday is still far away, you will need to take a cash advance. That is why we picked the best cash advance apps for you.

This is our pick of 15 cash advance apps like MoneyLion:

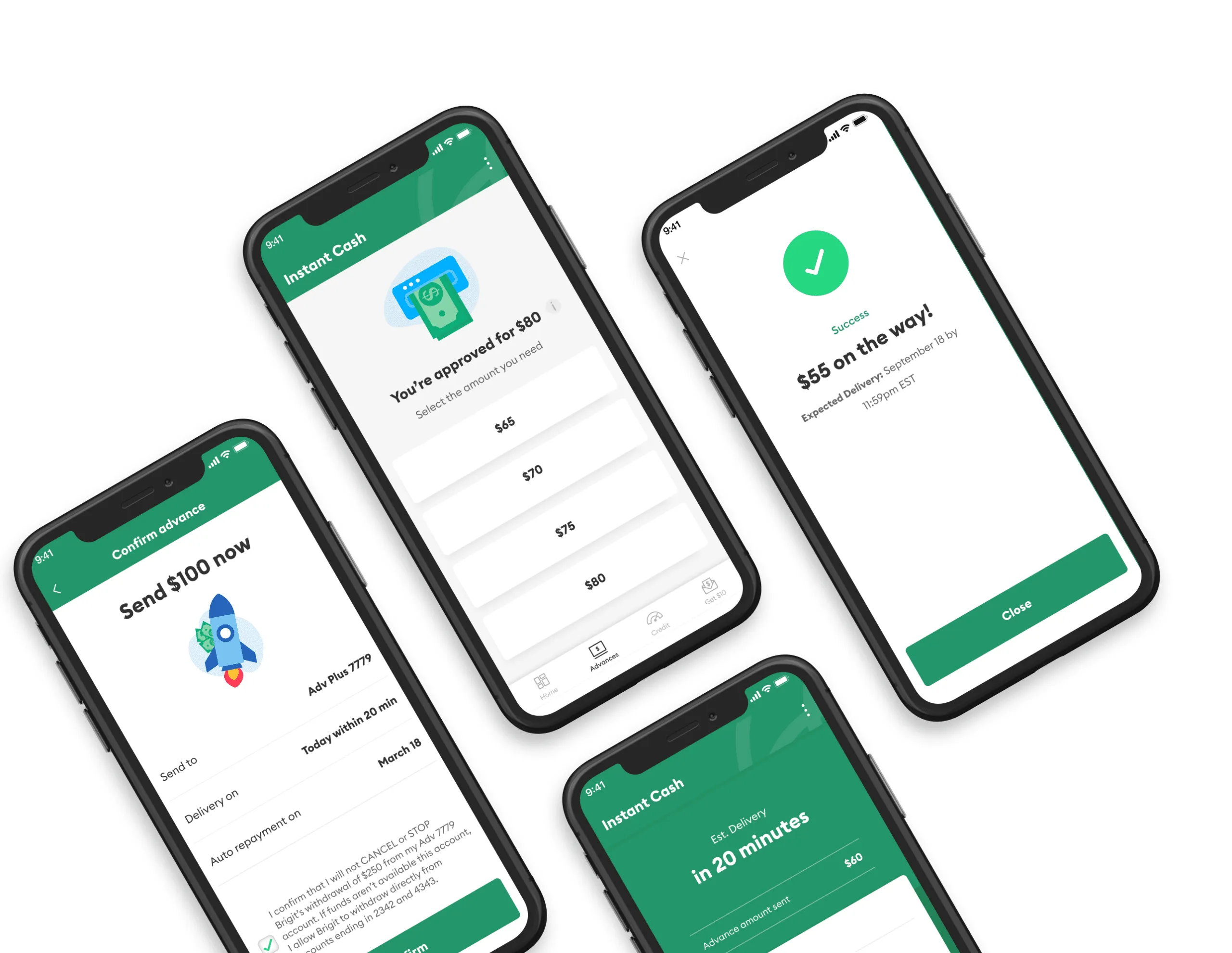

1. Brigit Cash Advanced App

The reason for its name, this app is commonly known as Brigit, which was specially created to help its users overcome the difficulties of a payment gap by bridging it.

And it does not end with transaction monitoring alone. Brigit is designed to detect possible overdrafts as well.

When Brigit sends you a message, you will have the option to have Brigit advance you up to $250 to stop the plug if the app learns you will land an expense that will take you to the border of overdraft.

The payback date will be on your account based on your activity, which Brigit will tell you when the notification is given.

To fabricate a product like Brigit Cash Advance App, dealing with a first-class mobile app development company in India is important.

This type of outsourcing agency is affordable and the quality of the solution is effective. Such outsourcing agencies are affordable and can provide good quality solutions.

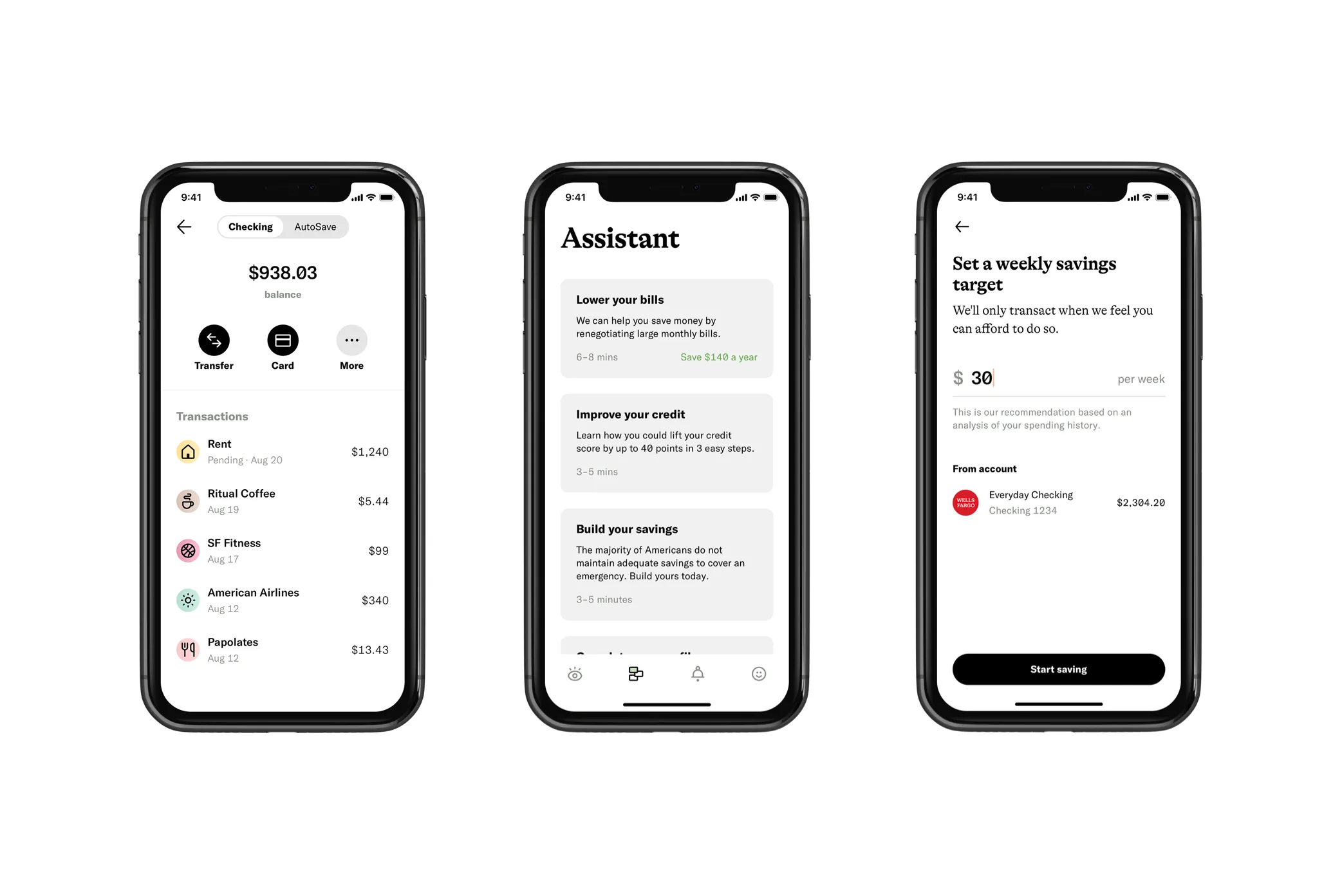

2. Empower Cash Advance App

Apps such as Empower give you a chance to receive an advance on your anticipated direct deposit and pay it back through a future deposit, just like other apps, for instance, money advance in a hurry.

Moreover, Empower’s forming refers to removing partial amounts from your account as a full sum is being written.

However, this is made possible without additional charges of interest or late payment fees.

To be accepted for the use of cash advances, you must prove your ability to earn consistently by showing the EMPOWER with bank statements and assistance to your bank account.

On the other hand, you can contribute to your savings account earlier or get free and immediate money just by making use of the Empower account.

Apps like Empower allow for great interface design (UI/UX) and have to be in-demand vendor company, for instance, Konstant provides native app development services.

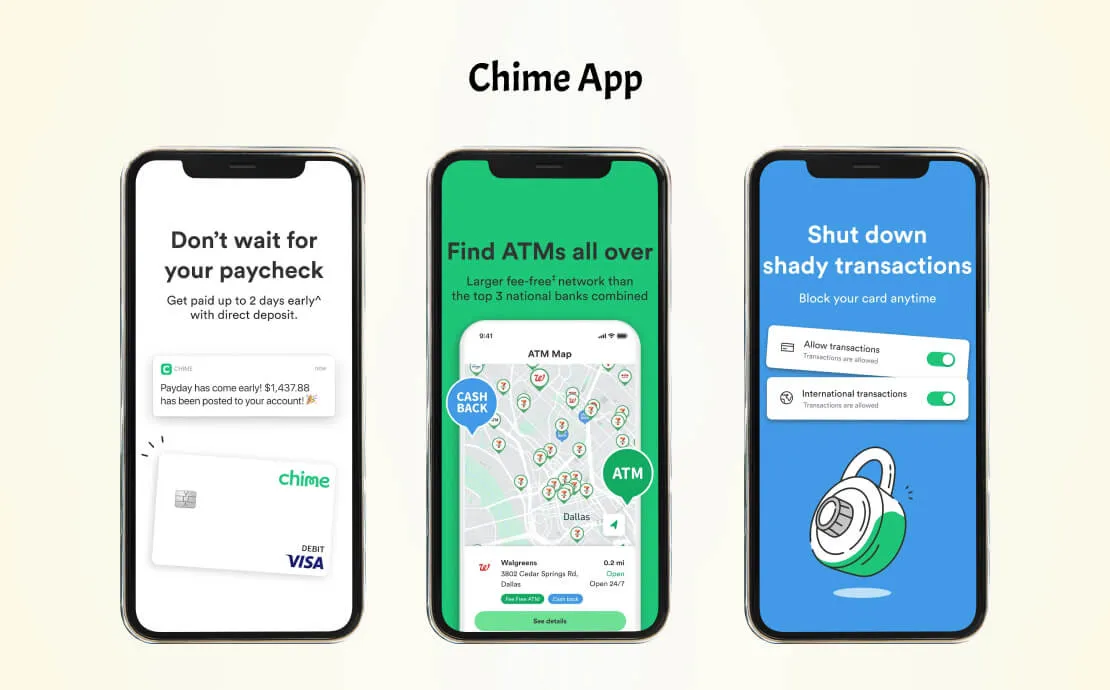

3. Chime

Chime is one of the best cash advance apps that works just like MoneyLion. It provides a modern type of banking service beyond expectations to its users.

Apps like Chime and MoneyLion give many advantages that you cannot get from a bank. Chime does not have the same expensive regular banking.

Although it does not give its users payday loans like your regular loan app, Chime gives you up to $200 overdraft when you use it with Chime’s Debit Card.

If accumulated charges result in an overdraft, Chime will pay what remains, even up to the maximum advance.

However, this is only possible if you are eligible for Chime’s SpotMe program.

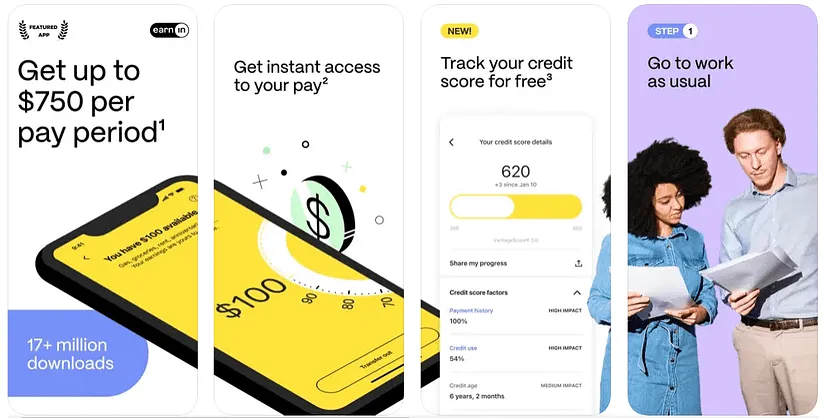

4. Earnin

Another cash advance app that works like MoneyLion is Earnin. They were the first to offer the Balance Shield Cash Outs and Alerts services.

To receive push notifications when the bank balance drops below an amount like $400, the customer must have activated the Balance Shield Alerts service.

Also, a customer can activate Balance Shield Cash Outs. This will automatically credit their bank account if the bank balance drops below $100.

With Earnin, you have a unique method of accessing your funds before payday by letting you take out a part of your pre-paid leftover money.

Note that you can receive the money within the next business day. With this, you do not have to wait till your next payday to survive.

READ ALSO!!!

- Free Instant Cash Advance Apps

- Top 6 Instant Cash Advance Apps to Use

- Top 5 Cash Advance Apps for Social Security Recipients

- Top 8 Cash Advance Apps that Work with Venmo

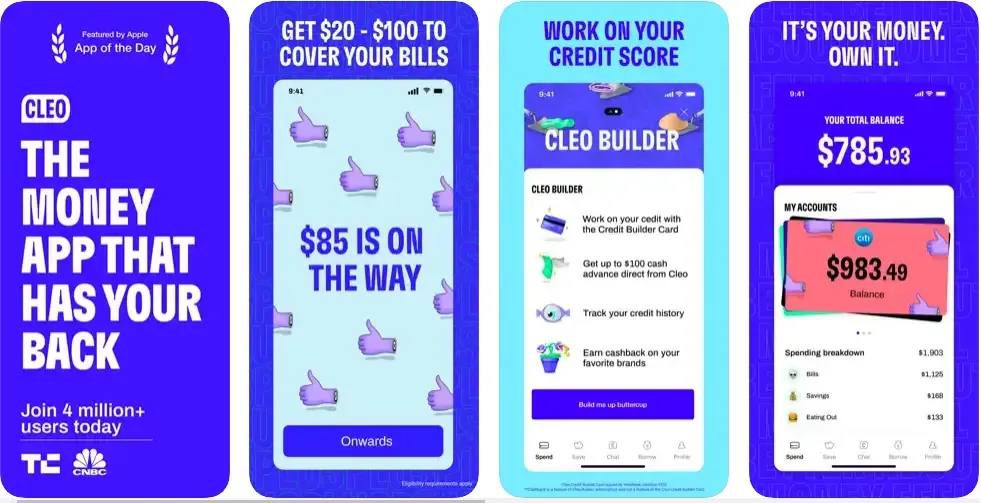

5. Cleo

The purpose of the Cleo Cash Advance app is to provide you with the kind of financial service that you would have enjoyed while using MoneyLion.

Cleo can help you reduce your consumption patterns. The app will make the whole experience look like you are consulting with a financial friend instead of a programmed algorithm.

Although it does not collect interest or check credit ratings, Cleo will charge you $5.99 as a monthly membership.

Besides giving out minor loans up to $100, cash apps like Cleo also offer accounts for credit building and budgeting assistance.

Most amazingly, the app can tell you what to do if you want to improve your credit score.

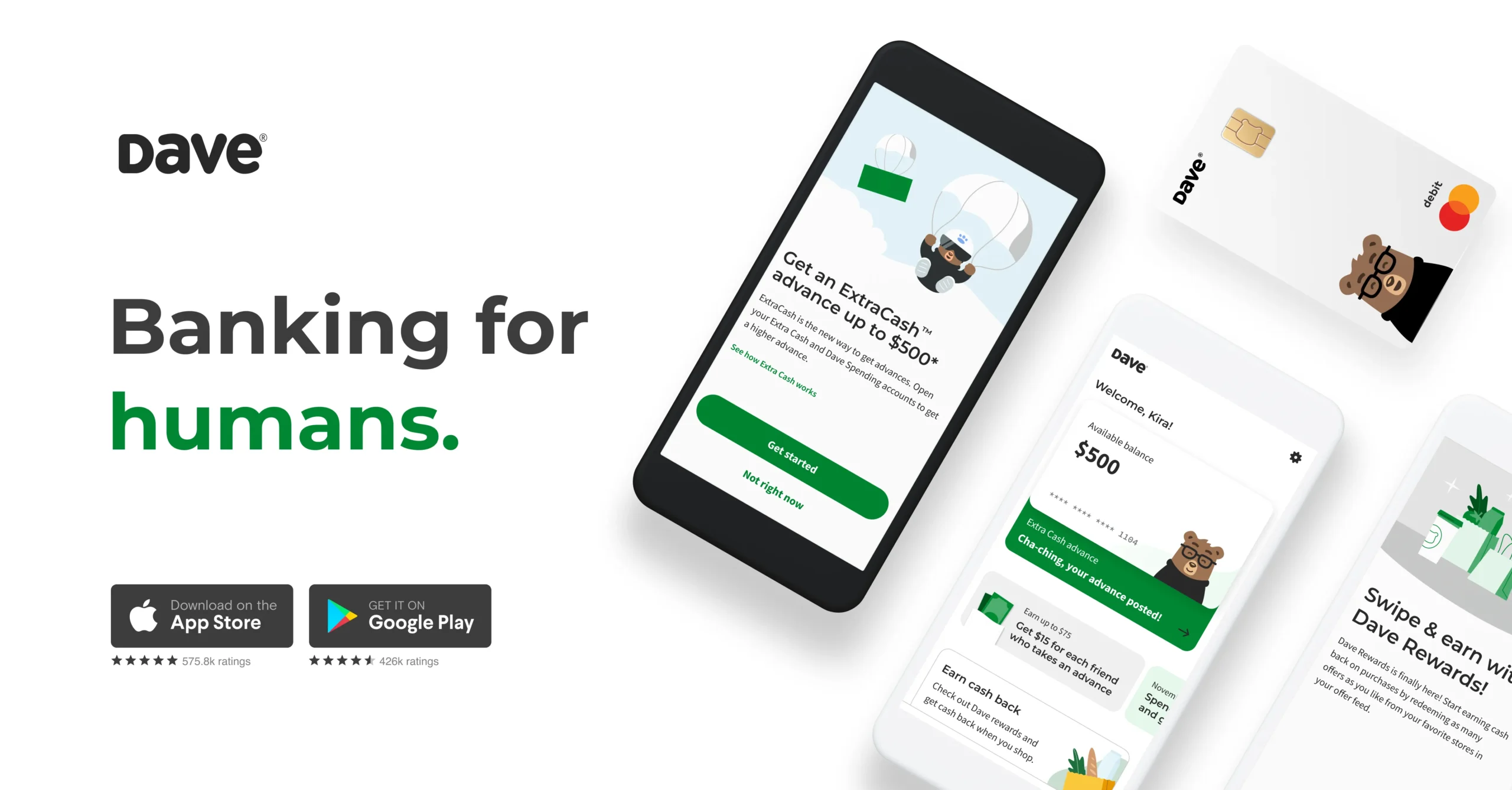

6. Dave

Dave is another popular app offering financial services. This app gained popularity after the investment of Mark Cuban, a billionaire businessman.

This is one app that describes itself as “Human-Banking”. This is because it helps customers to avoid overdraft costs.

You can prevent overdraft fees by adding Dave to your bank account. When there is an overdraft, the Dave app will notify you.

Yes, you will get up to a $100 loan but you will have to repay on your next payday.

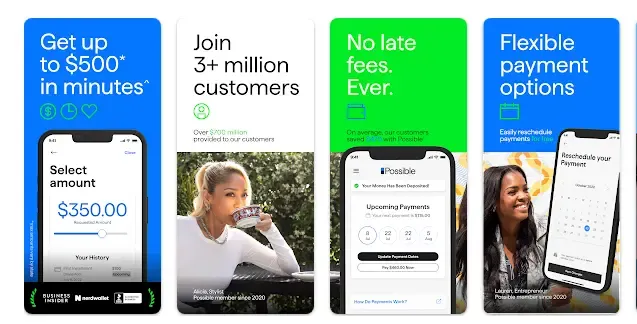

7. Possible Finance

Possible Finance is another app that can replace MoneyLion. It can give up to $500 in short-term loans in installments.

The rate differs according to the state where you live or come from. For every $100, you have to pay an interest rate of $15 to $20.

Converting it to percentage, you will find out that the annual rate is approximately 91% or 122%. There is a fixed two-month term for each loan.

Borrowers must make four installments spread over eight weeks until they repay the loan. When you make a repayment, Possible Finance will disclose it to other credit agencies.

This can help you build a good credit score.

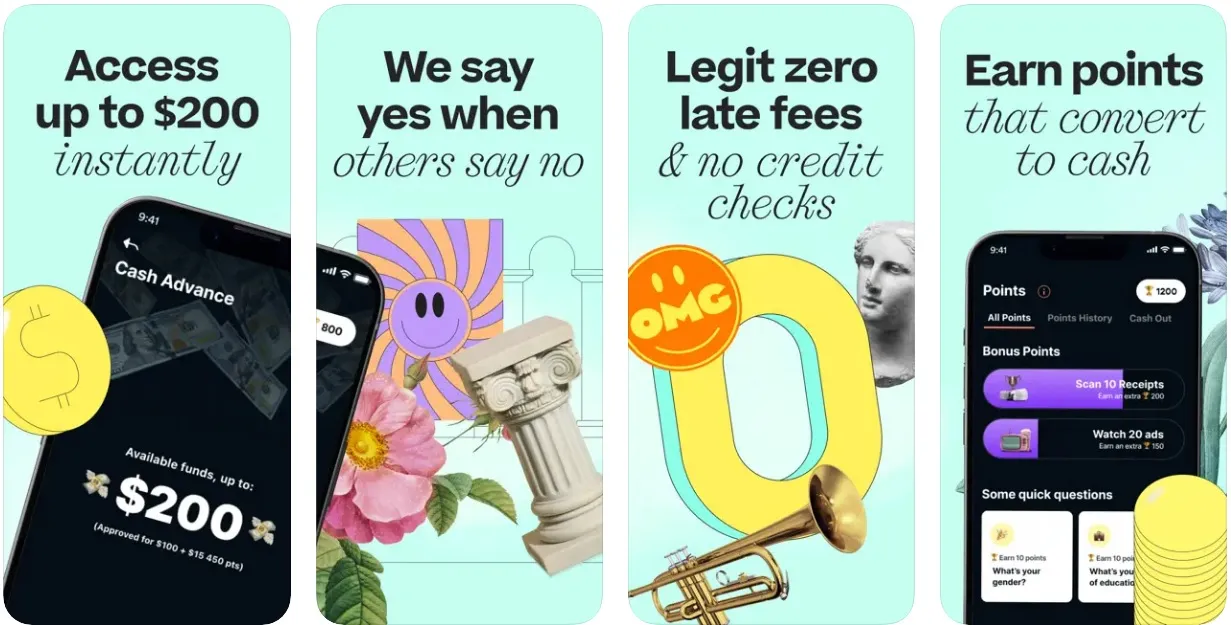

8. Klover

With apps like Klover, you can get a loan worth up to $200. The maximum amount you can borrow increases with time.

This is made possible through a point system. You start earning points when you sign up. These points grow as you use the app responsibly.

Note that you will need to pay $2.49 monthly as a membership fee. Also, to avoid paying fees on your cash advance, you might have to wait up to 3 business days to receive the money.

The need to pay an express fee depends on the volume of the loan amount, and how urgently you want the disbursement. The cheapest is $1.99, while the most expensive is $14.98.

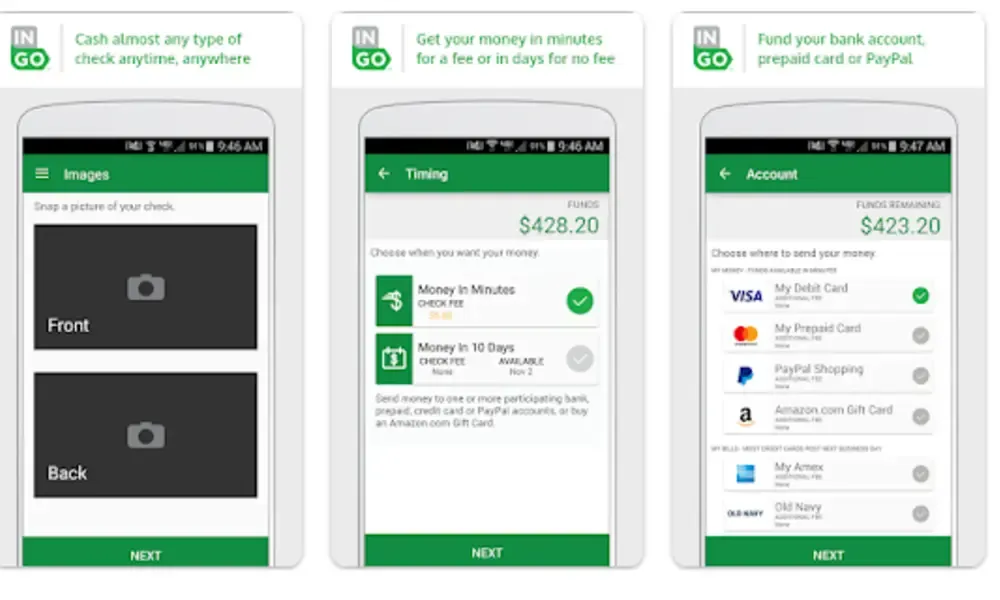

9. Ingo Money

Using Ingo Money, customers can achieve a lot with its instant money service, just like that of MoneyLion.

Activities like cashing corporate checks and more can be done with ease on this app. With cash advance apps like Ingo Money, transferring funds to any bank account is simple.

To use the app, you must first register an account. After that, you can link it to your PayPal, bank, and other accounts.

You can upload a photo of the check to be paid after the completion and acceptance of the profile.

READ ALSO!!!

- Top 10 Cash Advance Apps that Don’t Use Plaid Reddit

- 3 Top Cash Advance Apps with No Direct Deposit Required

- What Apps Let You Borrow Money with Prepaid Card: 5 Options

- Capital One Cash Advance Fee Guide

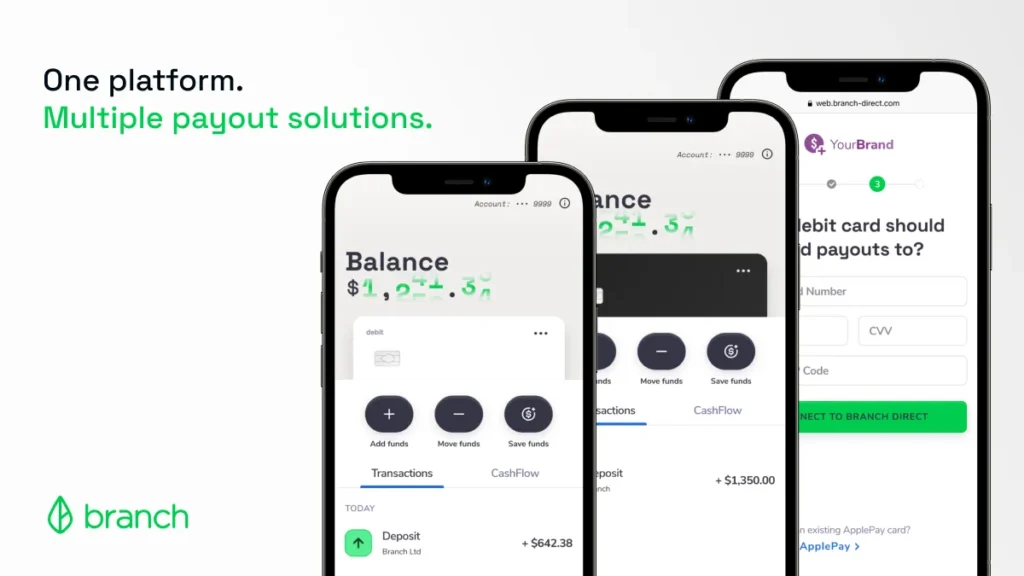

10. Branch

This is another replica of MoneyLion. With a nominal service fee, customers using the Branch app can obtain immediate funds for any type of financial emergency.

This ranges from $2.99 to $4.99 depending on the amount you request. If you want to cut down on service fees, you will get the exact amount you requested within 3 business days.

Though it is similar to Earnin and MoneyLion, this payday loan app does not favor remote workers, as they are needed to supply physical working proof and a copy of banking history from your bank.

These are the requirements you must meet before proceeding with the loan application.

Having gone through the above list, you will have confirmed that other cash advance apps can replace MoneyLion.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.