Which Country Owns Wells Fargo Bank?

Wells Fargo Bank is one of the leading and most recognized banks in America that flourished relentlessly and offers innovative and customer-oriented services. Due to it’s large customer base and popularity, one can hardly say where the bank originates from.

Wells Fargo, which was established in 1852 as a US-based company, has been a reliable company for helping people, companies, and other communities make the right decisions about banking, investing, and lending.

It remains clear and evident that Wells Fargo retains its stanchion of quality and elegance, especially due to its ability to provide a wide spectrum of finance.

Wells Fargo Bank Company Profile

Wells Fargo history was created during the California Gold Rush when Henry Wells and William Fargo, with the help of other investors, began to open the enterprise.

Originally performing the functions of the precious metal carrier and the mail service, the bank grew with its experience and diversified with what it offers to clients: loans, deposits, and investment services.

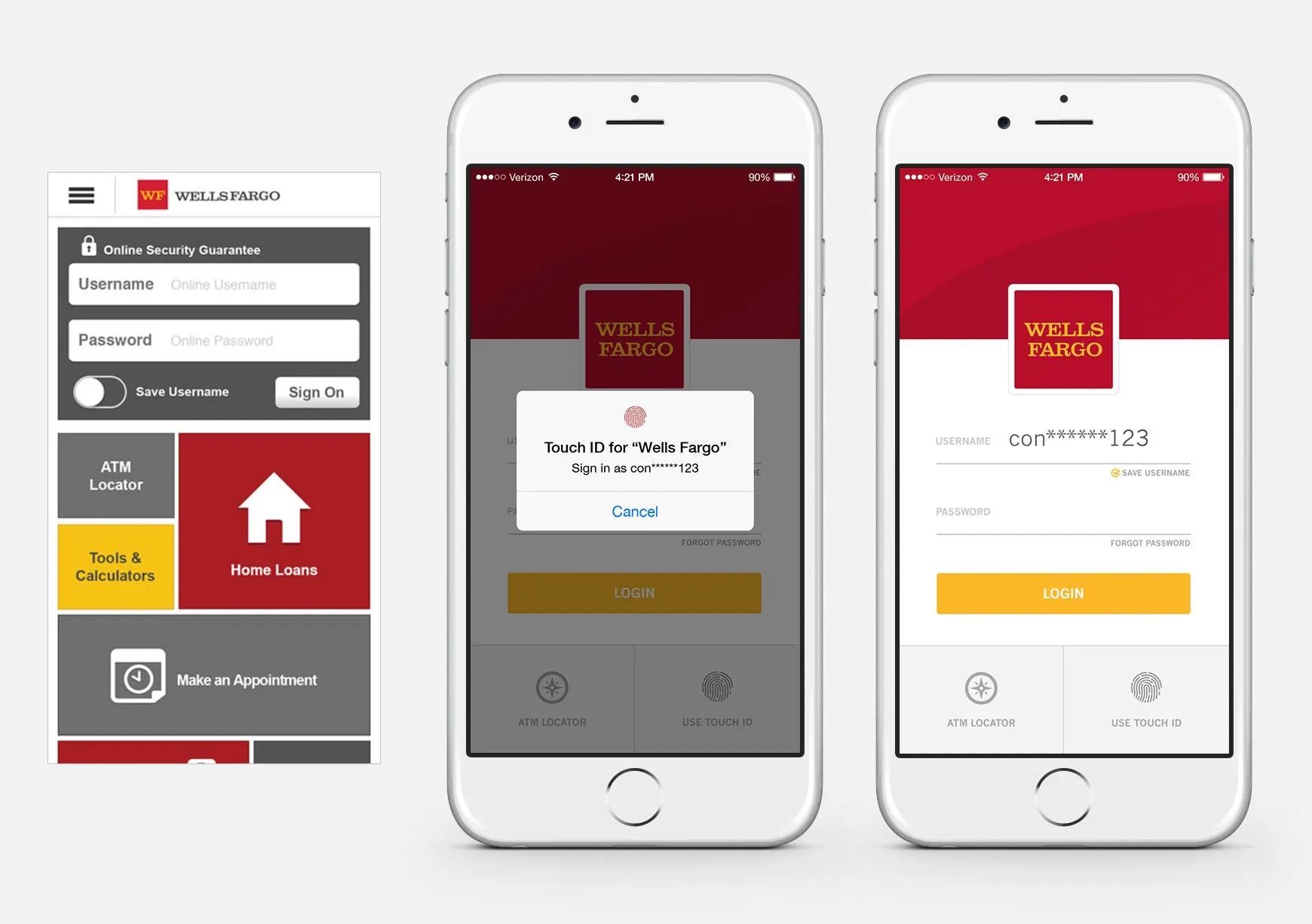

During the years of it’s existence, Wells Fargo adopted to new issues, becoming one of the pioneers of technological advancements in terms of banking, including online banking and those applications for mobile devices.

Currently, with more than 4000 outlets and operations in 35 different countries, Wells Fargo continues to be one of the pillars of American banking practices.

What are the Core Banking Services of Well Fargo?

The following is a list of financial products in banking by Wells Fargo meant to fit the needs of the customer. These include:

1. Personal Banking: Current and savings accounts, credit and debit cards, personal, vehicle, and home loans and mortgages.

2. Small Business Banking: Products including business loans, payment solutions, and payroll services.

3. Commercial Banking: Specific to the business organization special services such as treasury management and capital financing for large business entities.

4. Wealth Management: Planning for investment for the high wealth class and also wealth management or wealth planning.

One of the considerations that Wells Fargo has made is that their range of social banking applications grants easy access to customers for account operation as well as paying bills or transferring funds.

READ ALSO:

Role of Wells Fargo in Community Development

Community development has long been a source of pride for Wells Fargo. The bank’s corporate responsibility programs focus on:

- Affordable Housing: Grants to grow homes for the economically unstable families.

- Small Business Growth: Loaning money to people who create new businesses or give them money for their business.

- Environmental Sustainability: Promoting investment in renewable energy source projects and cutting down its emissions.

- Education and Financial Literacy: Establishing sponsorships towards the provision of scholarships plus several workshops concerning personal finance.

In these activities, WF shows that it’s not merely a financial institution; it is an ally in community development.

How do Wells Fargo Rewards Work?

On average, the Wells Fargo Rewards are equivalent to 1 cent per point. But more than one cent or a point per dollar can be made.

Determining how much cash you can make with the Wells Fargo Active Cash Card is easy, seeing that you get $0.02 back for every dollar you spend or $2 in every $100 spent.

With regard to credit cards, Wells Fargo offers powerful rewards for clients that make the usage of plastic money even more pleasant. These include:

- Go Far Rewards: Redeem points for other products such as travel, gift cards, or other cash equivalent rebates.

- Cash Back Credit Cards: Extending Grocery/Gas/Dining rebates at a certain percentage basis on the costs incurred.

- Travel Benefits: Negotiation of special fares for flights, cheap accommodation for hotels, and cheap car rental firms.

Such rewards not only increase value but also make Wells Fargo a better choice for many customers.

Realizing the Issues of the Past and Gaining Trust

Nonetheless, Wells Fargo’s has not been immune to scandals, some of which are unauthorized accounts and charges to its customers. However, the bank has taken significant steps to address these challenges:

- Leadership Changes: Paying attention to new executives that should be hired in order to improve the ethical standards of the organization.

- Customer Compensation: Compensating those customers who have suffered and optimizing the handling of customer complaints.

- Transparency: Improving the ways that customers are informed about policies and procedures within the business organisation.

- Oversight: Tightening internal premises and increasing cooperation with the authorities.

They may be indicative of the company’s commitment to rebuilding public confidence and dispensing its social responsibilities as a rational retail bank.

Does Wells Fargo Have a Digital Bank?

Wells Fargo Bank, like many other conglomerates in the digital banking sector, has incorporated technology in the delivery of services. Highlights include:

1. Mobile App: An easy-to-use solution for keeping track of accounts, payments, and expenses.

2. Online Banking: Such services would include paperless statements, account alerts, and ease in fund transfers.

3. Virtual Wallet: Incorporation of Apple Pay, Google Pay, and Samsung Pay as Request for Contactless Payments.

4. Cybersecurity: Uses of superior-level encryption and better fraud monitoring to ensure the customers’ data security.

The firm’s innovation policy guarantees the consumer is serviced anytime and anywhere in regards to their financial needs.

READ ALSO:

- Temu Scams: Debunking the Myths and Protecting Yourself Online

-

How Credit Card Revealer Applications Work With IOS and Android

What Impact Has Wells Fargo’s Created Globally?

It traces its origin to America even though its impact is felt worldwide. With offices in Asia, Europe, and Latin America, the bank supports international businesses through:

- Global Trade Solutions: Purchasing or acquiring foreign goods either to pay for imports or export the goods locally.

- Foreign Exchange Services: Assisting various organizations in undertaking currency risks and transacting in a foreign currency.

- Investment Opportunities: Bringing the international buyers and sellers together with the American markets.

It shows Wells Fargo’s flexibility and the possibility of satisfying the needs of a wide client base.

Our Verdict

The above details are a clear testimony that Wells Fargo Bank has been in a position to demonstrate a lot of flexibility and to change its strategies, making the bank a key player for every banking client.

From its historical days of establishment, it offered services to society and grew to plan its digital services to expand global control to empower its customers economically.

Through transparency, customer-defined outcomes, and ethical approaches to operations, Wells Fargo has become a bank of every generation.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.